Green bonds: a step towards a carbon-neutral future for Latin America

The decarbonization of the global economy was one of the central themes during the World Economic Forum in Davos and is one of the key steps in reversing our…

The decarbonization of the economy is one of the indispensable measures to achieve a future below the 2 degree Celsius temperature increase that is necessary for the climate crisis to be contained.

That is why it was a central topic at the annual meeting of the World Economic Forum held in Davos from 21 to 24 January.

The panel "Creating a carbon-neutral future" addressed this issue, taking into account that only 33% of primary energy (i.e., that derived directly from natural resources such as light, wind, carbon, gas or oil) is efficiently converted into energy we use for the activities that support our way of life. Where does the remaining 66% go? How can we make the most of it?

If we manage to keep energy loss to a minimum, we will be much closer to achieving a future where our carbon emissions are neutral and therefore our future will be much more sustainable.

Systemic efficiency, where all factors in the production chain and all sectors are taken into account, must also occur across the globe, not only in Europe (where the Davos panelists have had some of their most successful experiences).

Within the quest for a carbon-neutral life, the question of generating clean energy is the most pressing of all, since the carbon dioxide emissions of the energy sector are responsible for the vast majority of greenhouse gases emitted into the atmosphere every year.

The emissions caused by coal mines, which are responsible for 40% of carbon dioxide emissions from the energy sector globally, are a major concern. The complexity lies in the fact that the areas that produce the highest CO2 emissions from this cause are also those where the most people live in poverty or misery.

The vicious circle is that lifting these people out of poverty involves very high energy demands, as well as multi-million dollar investments in both social investment and energy transition. To understand this bottleneck, one has to imagine a person who has to spend all day carrying water, cutting wood for cooking or heating. In these conditions it is impossible for someone to improve their economic conditions or produce value for society, reducing the carbon footprint is something that cannot be considered.

This is the case for millions of people in India and China, where in addition to being the majority of the population globally, there are also the largest coal mines. In Latin America and Africa it is also happening, but in the latter, according to Amani Abou-Zeid, Commissioner for Infrastructure and Energy of the African Union, the transition will have to move directly from wood to clean energy.

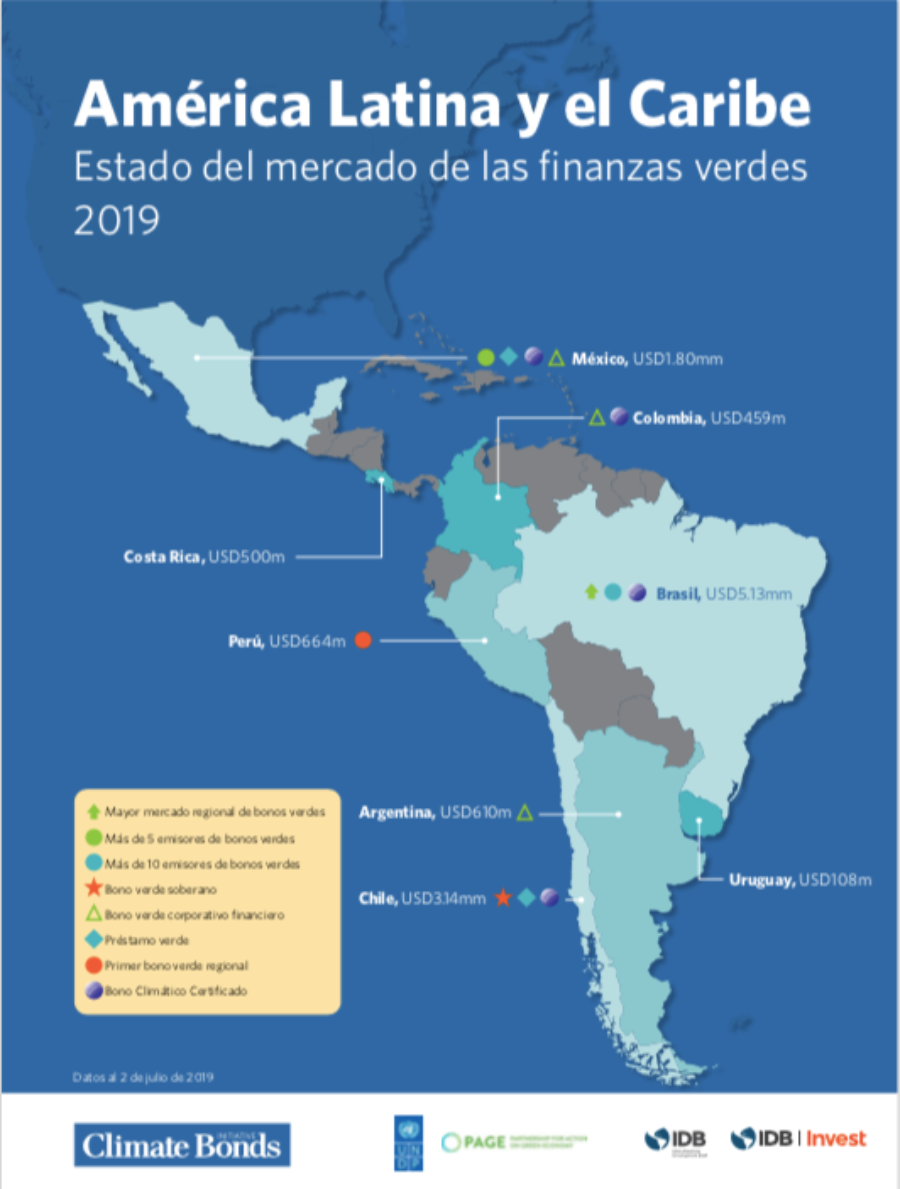

This is why it is very important to develop the green bond market in Latin America, whose potential is enormous, as shown by the report of the Climate Bonds Initiative, made with the support of the UN and the IDB.

The bond market is, in simple terms, the purchase and sale of the debts acquired by a country, a city or a company that is looking for financing for very expensive developments.

Green bonds, as understood by the Climate Bonds Initiative, are those in which at least 95% of revenues are invested in climate-aligned assets and green business lines. In general, they correspond to the following sectors: energy, buildings, transport, water, residues, land use, industry and information technology.

RELATED CONTENT

The growth of this market is important because it tends to encourage more investment in the fight against climate change and, as Christiana Figueres (co-founder of Global Optimism and negotiator of the Paris Agreement) pointed out in Davos, the financial sector is one of the few that is moving with real speed.

Latin America and the Caribbean still accounts for barely 2% of the global green bond market. However, this is not insignificant considering that the first green bond in Latin America and the Caribbean was issued in 2014 and has accumulated $12.6 billion in six years.

During 2019 the green bond market in Latin America had an important growth, only in the first semester bonds were issued for 3.7 billion dollars: three times more than in the first semester of 2018 and 40% more than in the same period of 2017. It was a record year.

In terms of the use of the bonds, Latin America is unique. Globally, the most financed sector is the energy sector, a trend that continues in Latin America, but here the next two most benefited sectors are land use and industry. Two sectors that, in contrast, are among the most underfunded in the rest of the world.

A portion of those green bonds went to the agricultural sector, but the majority went to forestry and certified paper, especially in Brazil, which is the Latin American country that has had the highest historical amount of green bonds: 5.13 billion dollars.

Chile, which has a historic $3.14 billion in green bonds, is the second most developed market in the region in this regard. Chile was the big leader in the green bond market in Latin America during 2019 and the first to issue two sovereign bonds: one for $1.4 billion dollars and the other for 861 million euros. Most of these funds were earmarked for low-carbon transport, which is a great singularity. In fact, Chile is the second country with the largest fleet of electric buses, after China.

Mexico has the third largest green bond market in Latin America, with a historic $1.8 billion. This is despite the fact that the market has been stagnant since December 2018, when the new Mexico City airport, NAICM, was cancelled. It was to be the largest infrastructure project financed with green bonds that had been made so far. When it was cancelled, $6 billion in green bonds were lost, which has meant that no more have been issued since then.

As the Climate Bonds Initiative report shows, the other markets in Latin America are smaller, but still have interesting singularities: Peru was the first country in the region to issue green bonds, which have been used for the development of clean energies (wind and solar, especially). Adding Peru's record, two bonds issued at the beginning of the year and a third one issued after the closing of the report, the Andean country would complete a total of 1,056 million dollars.

The road ahead is long but the trend, although slow, is favorable. The growth of this market can contribute not only to improving everyone's future at the environmental level, but also to reducing social inequality, something for which Latin America is crying out.

LEAVE A COMMENT:

Join the discussion! Leave a comment.